Step Up SIP Calculator SBI – A Smart Way to Grow Your Wealth

Systematic Investment Plans, or SIPs, have turned into a favorite for many in India when it comes to mutual funds. The idea is straightforward: put in a set amount each month and let compounding do its thing over the years. But life doesn’t stand still—your salary might go up, responsibilities change, and inflation keeps chipping away at what your money can buy. That’s why the Step Up SIP Calculator SBI is such a handy tool, helping you plan investments that keep up with real life.

This calculator from the State Bank of India doesn’t just figure out basic SIP returns; it lets you see how bumping up your investments each year can really boost your long-term savings. Getting familiar with it can help you make sharper choices and stay ready for whatever financial goals come your way.

Why Investors Prefer SIPs with SBI

SBI stands out as one of India’s most reliable banks, with a bunch of mutual fund options that fit all kinds of investors. Their SIPs let you start small and build up your wealth step by step.

Pair that trustworthiness with easy-to-use online tools like the SBI SIP calculator with step up, and it’s a win for newbies and pros alike. If your income is on the rise, the step-up SIP is especially useful since it lets your contributions grow right along with your earnings.

The Concept of Step-Up SIP

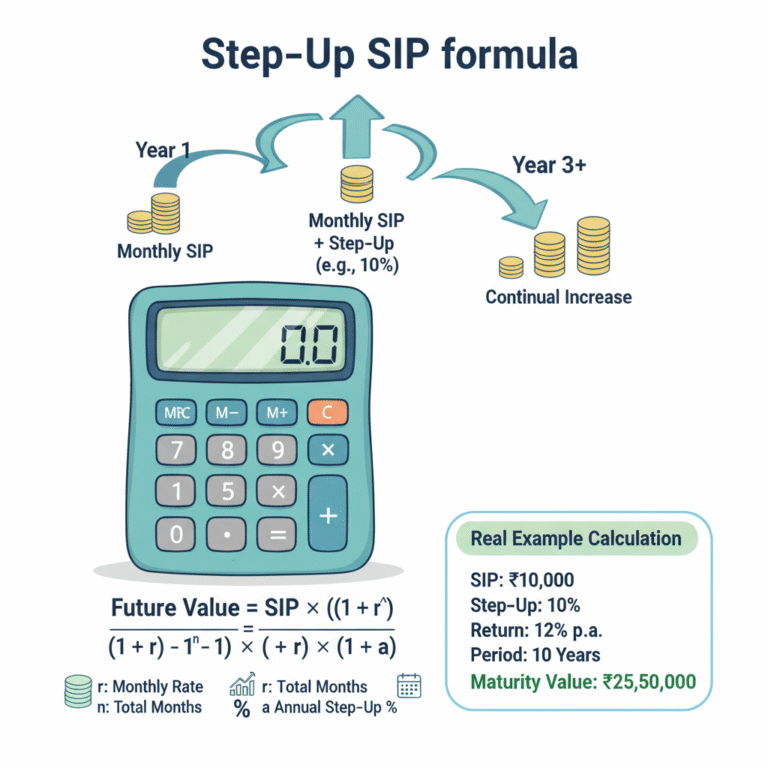

With a standard SIP, you stick to the same monthly amount for the whole ride. It’s solid, but it might not match how incomes usually climb year by year. A step-up SIP (or top-up SIP) gives you the option to raise that amount by a certain percentage or fixed sum at set times, like annually.

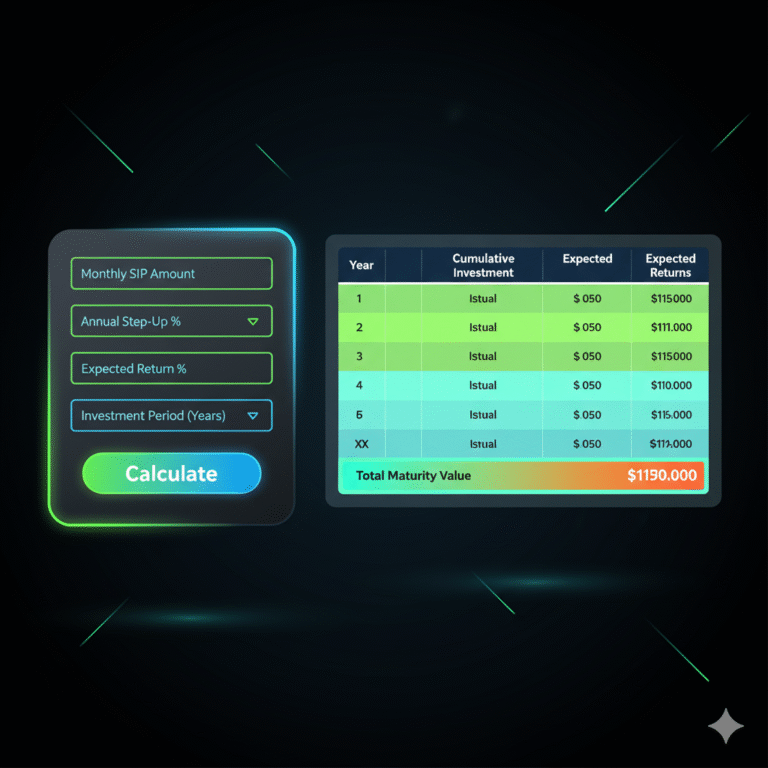

The step up SIP calculator SBI shows you exactly how these boosts affect your total savings. It makes it easy to compare a flat SIP with one that steps up, highlighting the perks of the latter.

Features of the Step Up SIP Calculator SBI

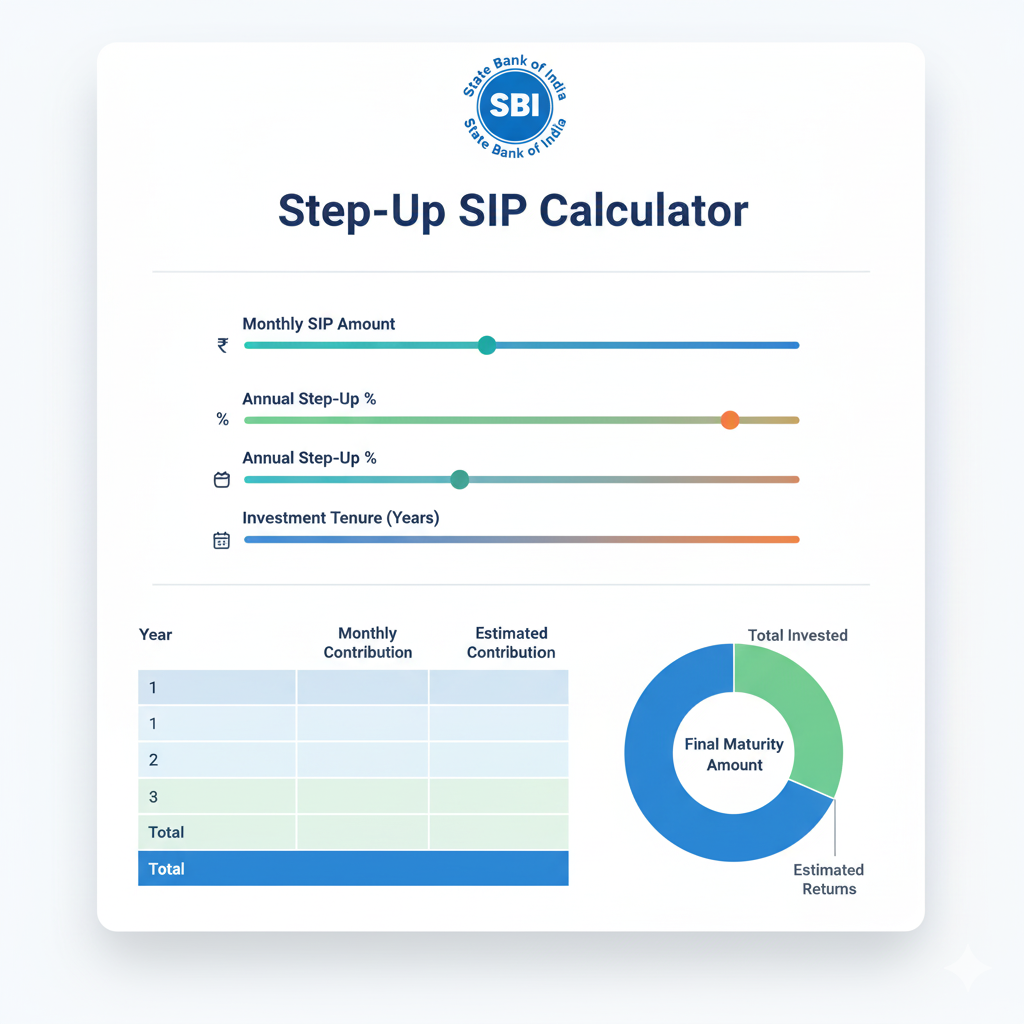

The SBI step up SIP calculator comes packed with useful perks:

- It projects the future value, factoring in those yearly increases.

- You can tweak things like your starting amount, expected returns, how long you’ll invest, and the step-up rate or amount.

- Results come out clear and simple, so you don’t have to wrestle with tricky math.

- It promotes steady investing by showing how little bumps add up to big gains.

This makes it a favorite for financial planners and everyday folks wanting to sync their plans with income growth.

How the Calculator Works in Practice

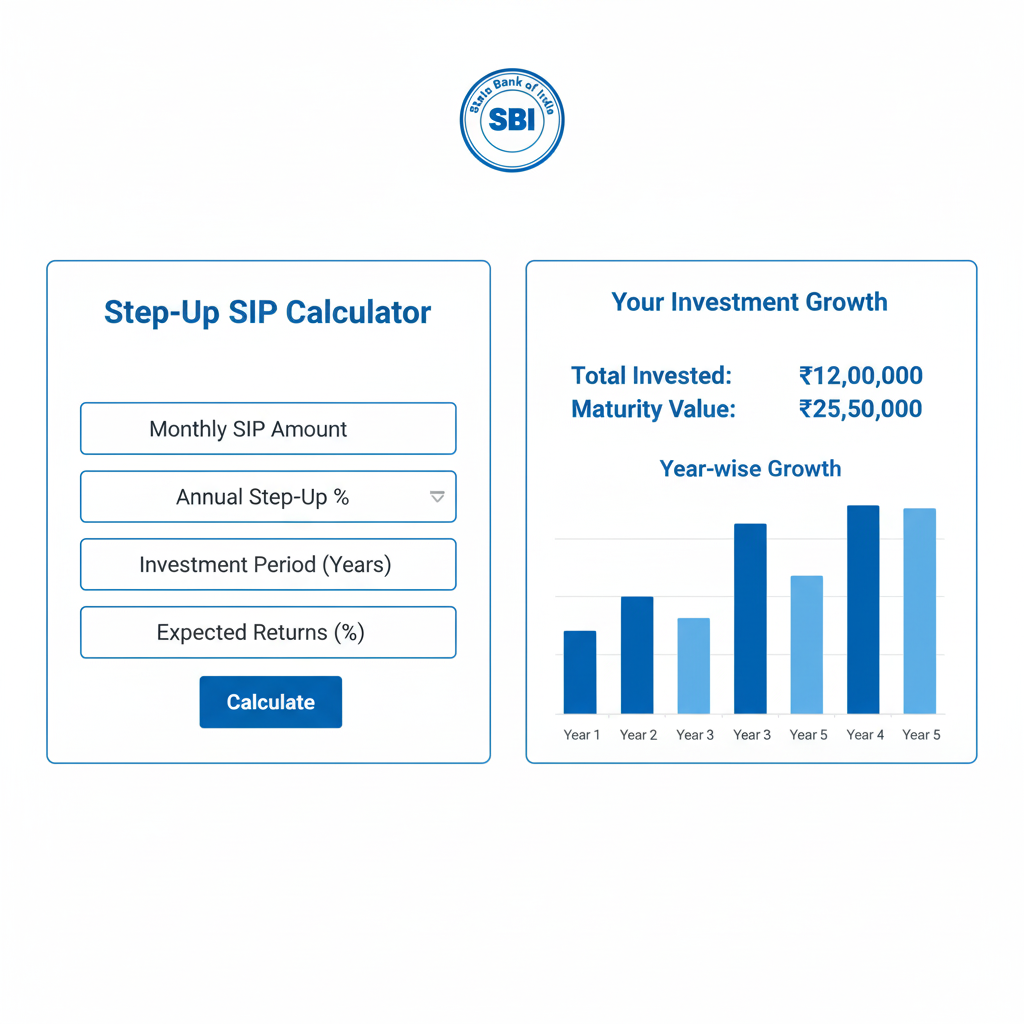

Imagine kicking off with ₹5,000 a month in an SBI mutual fund, then adding ₹500 more each year. At 12% returns over 15 years, the step up SIP calculator SBI would reveal a much bigger final amount than if you’d kept it flat at ₹5,000.

The figures really drive home the impact of those gradual increases. Even small ones compound into serious money, helping hit targets like retirement, kids’ schooling, or a new home.

Why Step-Up SIPs Are a Better Strategy

Inflation sneaks up and eats away at your money’s value. A fixed SIP might not cut it for future needs. Going with a step-up and using the SBI calculator lets you build investments that match inflation’s pace.

Plus, it capitalizes on pay raises and extra income. Rather than blowing it all on lifestyle upgrades, channel some into savings. This steady habit builds a bigger nest egg and gets you to financial freedom quicker.

Mutual Fund and Step Up SIP Calculator SBI Options

SBI’s mutual funds span equity, debt, hybrid, and sector-specific ones. Most support SIPs with the step-up feature. You can use the SBI SIP calculator with step up to test different schemes and pick what fits your goals.

For instance:

- Equity funds work great for long-haul stuff like retirement or growing wealth.

- Debt funds offer stability for shorter plans.

- Hybrids mix it up for balanced progress.

The calculator lets you see varying growth across these, making choices easier.

The Mathematics Behind the Step Up SIP Calculator SBI

You could crunch the numbers by hand, but it’s a pain. The formula looks at your start amount, step-up, returns, and time frame. Each boost gets treated like its own mini-SIP, with compounding applied.

The step up SIP calculator SBI handles all that automatically. Just enter a few details, and you get spot-on estimates of your end total.

Benefits of Using Step Up SIP Calculator SBI

- Sharper goal setting: For education, retirement, or building wealth, it sets real expectations.

- Flexibility: Play around with scenarios by adjusting the inputs.

- Clear insights: It breaks down growth without any guesswork.

- Motivation boost: Seeing what small changes can do encourages sticking with it.

Comparing Step-Up SIP with Fixed SIP

Take two cases:

- Fixed ₹10,000 SIP for 20 years at 12% returns.

- Step-up starting at ₹10,000, up 10% yearly, same setup.

The step-up wins big on the final amount. The step up SIP calculator SBI lays this out plainly, showing why ramping up pays off long-term.

Why SBI Investors Trust Online Calculators

SBI’s solid rep for safety and reliability makes people comfy with their tools. The SBI step up SIP calculator delivers accurate, open, and easy results, no need for fancy finance know-how.

It ties right into SBI’s mutual fund site, so you can check schemes and kick off SIPs straight after calculating.

Role of Step-Up SIP in Financial Discipline

Staying consistent with investments is tough for many. Folks drop SIPs or forget to bump them up with income rises. A step-up SIP builds in that discipline automatically.

It funnels part of every raise toward future goals, cutting reliance on loans and beefing up security.

Psychological Comfort with Step-Up SIPs

A lot of people balk at starting with big SIP amounts. Step-ups fix that—you begin small and comfy, then gradually up it. This eases the mind while still stacking up a solid fund.

The step up SIP calculator SBI lets you picture this progress, keeping you pumped for the journey.

The Long-Term Advantage of Step Up SIP Calculator SBI

For wealth building, time and steadiness are king. Step-ups make the most of both. By growing contributions, you compound on a bigger base, sparking exponential gains.

The SBI step up SIP calculator crunches these perks into numbers, showing the true value of committed investing.

FAQs on Step Up SIP Calculator SBI

Final Thoughts

Financial planning isn’t about quick fixes—it’s ongoing smart choices. The Step Up SIP Calculator SBI is ideal for syncing investments with income ups and inflation.

Starting modest and stepping up yearly lets you hit independence with less hassle and more surety. SBI’s trust factor plus this calculator make future planning a breeze.

No matter if it’s retirement, education, or wealth—step-up SIPs keep your savings matching your dreams.