Step Up Sip Calculator Formula for Smarter Investing

In India’s personal finance scene, Systematic Investment Plans (SIPs) have become incredibly popular for folks looking to grow their money steadily without too much risk. A basic SIP is already a solid option, but it doesn’t always match up with how our incomes and costs tend to rise over time. That’s where the step up SIP calculator formula really shines.

Getting a handle on this formula lets you plan your investments better, forecast returns more accurately, and make smarter decisions for your long-term goals. Let’s break it down—what it is, how it works, and how it can level up your investing game.

Why Step Up Sip Calculator Formula Matters in Financial Planning

A regular SIP means putting in the same amount every month for years. It’s awesome for tapping into compounding, but life isn’t static. Your salary might increase, inflation creeps up, and your financial needs change.

With a step-up SIP, you can gradually boost your monthly investments—maybe by a percentage or a set amount. This keeps your savings in line with your growing income and the economy’s inflationary pressures.

Using the Step Up Sip Calculator Formula shows how these boosts can seriously amp up your final amount, often doubling or tripling what you’d get from a flat SIP.

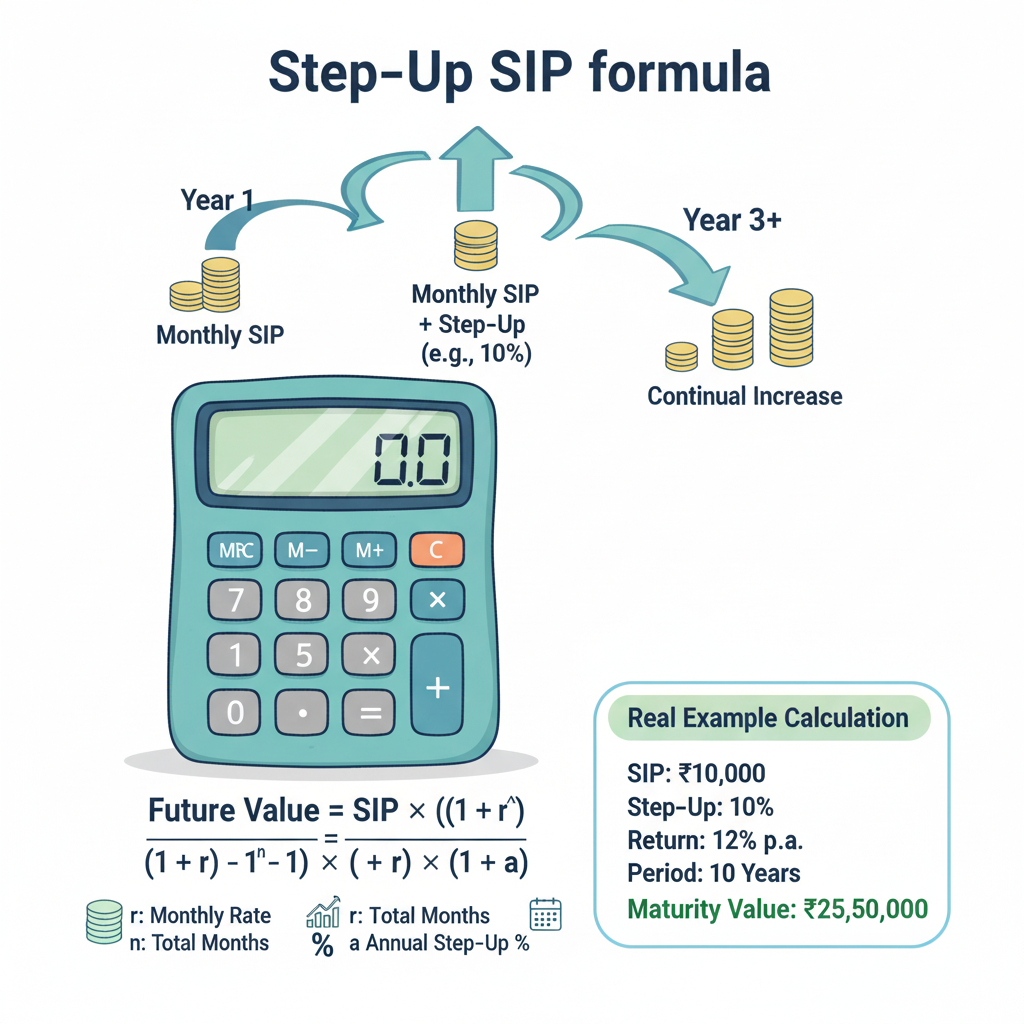

Breaking Down the Step Up Sip Calculator Formula

At its heart, the step-up SIP math revolves around three key things:

- Your starting monthly SIP amount

- The yearly increase (either a percentage or fixed rupees)

- The expected return rate over the years

It’s a bit trickier than a standard SIP because the contributions change annually. In simple terms, it goes something like this:

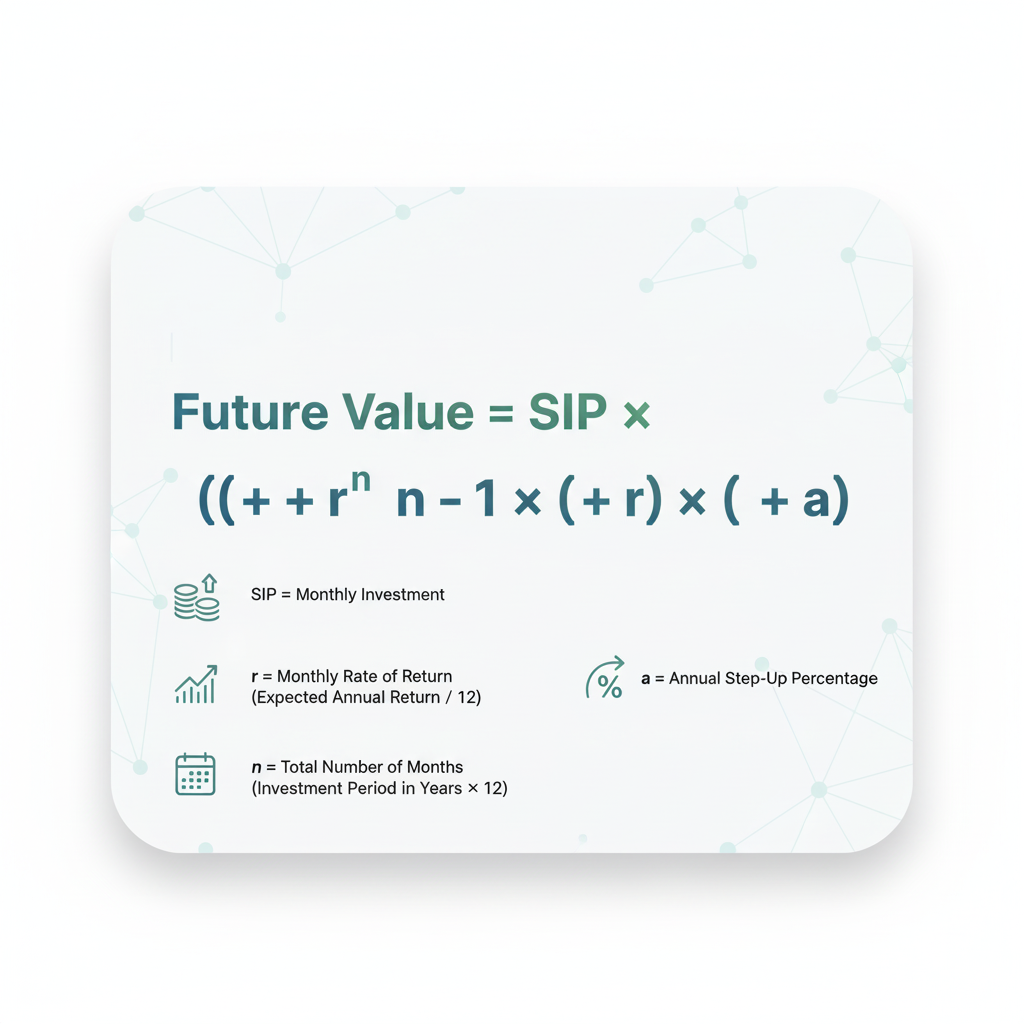

Future Value = Σ [ (SIP + (Step-up × Year)) × (1 + r/n) ^ (n × t) ]

Where:

- SIP = Your initial monthly amount

- Step-up = The annual bump (fixed or percentage)

- r = Expected yearly return

- n = Compounding times per year (usually 12 for monthly)

- t = Total years

Basically, each year’s increase is like starting a mini-SIP, and you add up all their compounded growth to get the total at the end.

Understanding the Formula Through a Real Example

Picture this: You start with ₹5,000 a month and add ₹1,000 more each year. At 12% returns over 15 years, the step up SIP calculator formula might project around ₹40–45 lakhs in the end.

Stick with just ₹5,000 flat, and you’re looking at about ₹25 lakhs. That’s a huge jump—nearly 70% more—just from those steady increases.

This is why pros suggest using a SIP calculator with step up formula over plain old static ones.

How the Formula Differs from Regular SIP Calculations

A standard SIP formula is:

FV = P × [((1 + r/n)^(n×t) – 1) / (r/n)] × (1 + r/n)

Here, P is your fixed monthly investment, with r, n, and t as before.

It assumes everything stays the same. But with step-ups, you tweak it by layering in multiple mini-calculations for each increase, making the projection way more flexible.

Why the Step Up Sip Calculator Formula is So Powerful

What makes this formula stand out is its flexibility. It doesn’t trap you in one amount—it evolves with you. That means:

- Bigger compounding: Those increases add more cash that starts growing sooner.

- Inflation fighter: Stepped-up investments help offset rising costs.

- Goal matching: For retirement, education, or a home, it helps figure out what you need and how to hit it.

Percentage-Based Step Up vs Amount-Based Step Up

The formula adapts based on your choice.

- Percentage-based: Grows by a set rate, like 10%—so ₹10,000 becomes ₹11,000, then ₹12,100, etc. Ties nicely to salary hikes.

- Amount-based: Adds a fixed sum, say ₹1,000—so ₹5,000 to ₹6,000 to ₹7,000. Straightforward and easy to budget.

Either way, the step up SIP calculator formula handles it for spot-on estimates.

Psychological Benefits of Using the Formula

A cool side effect of step-up SIPs is the mental ease. Lots of people shy away from big starting amounts. This lets you begin small and ramp up gradually. Seeing the growth via the step up SIP return calculator formula builds confidence and keeps you motivated to stick with it—key for long-haul investing.

Practical Applications of the Formula

- Retirement: Factor in inflation for a cushy post-work life; the formula shows annual boosts needed.

- Kids’ Education: Costs skyrocket faster than inflation—parents use it to plan ahead.

- Wealth Building: Aiming for financial freedom or early retirement? It maximizes compounding.

Common Mistakes Investors Make Without the Formula

Some folks just hike their SIP now and then, thinking it’ll work out fine. But without the step up SIP calculator formula, they might misjudge the end result, leaving gaps in plans.

Others get too rosy with return expectations. The formula keeps things real by showing how tweaks affect outcomes.

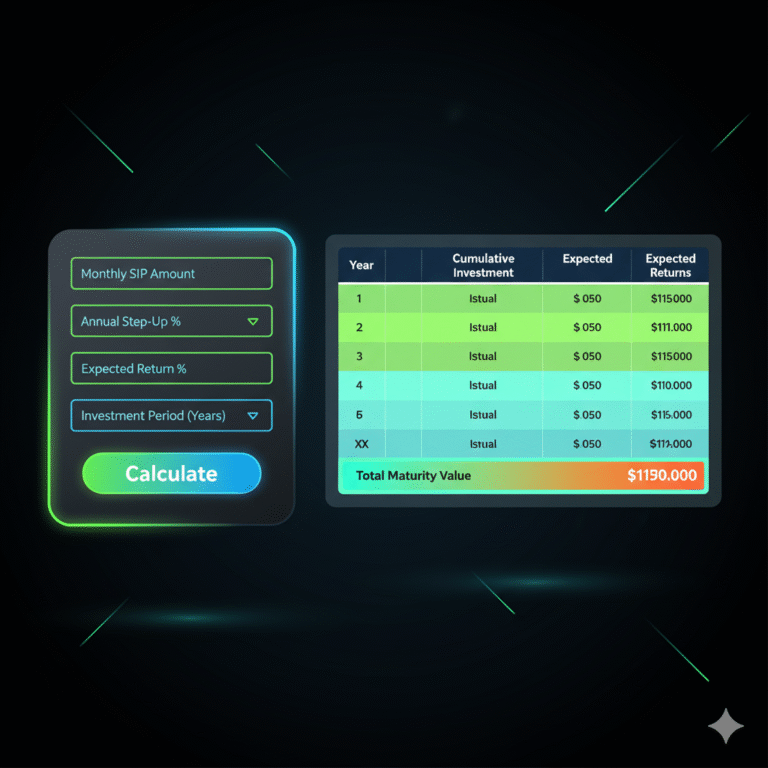

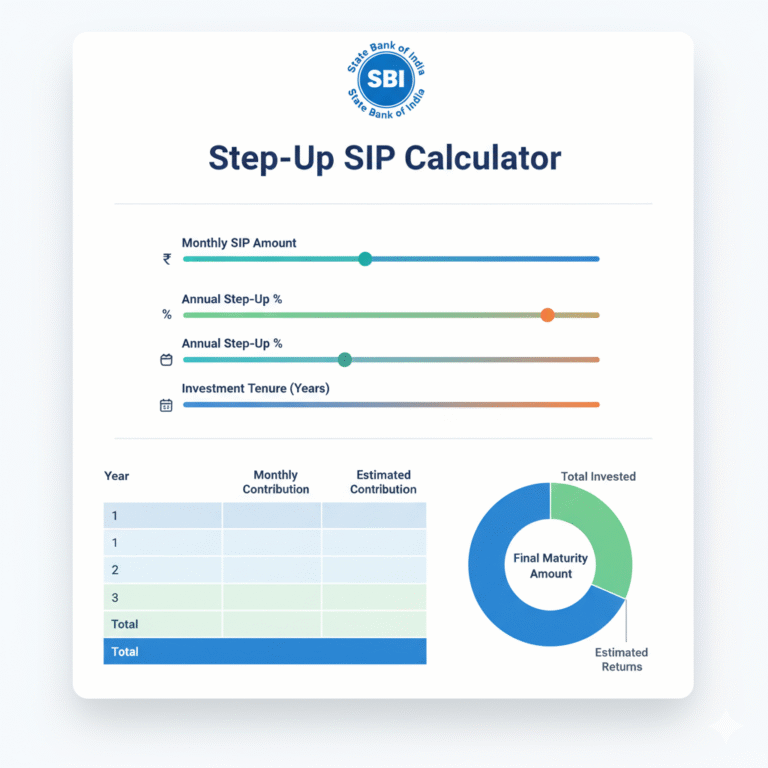

The Role of Online Step Up SIP Calculators

You could do the math by hand, but it’s a hassle. Online tools with the SIP calculator with step up formula make it instant—just plug in your numbers for quick maturity estimates.

Financial advisors, fund sellers, and everyday investors love these for clear, time-saving insights that drive better choices.

Step Up SIP and the Power of Compounding

Einstein dubbed compounding the “eighth wonder,” and it fits SIPs perfectly. Add yearly boosts, and it goes into overdrive. Each step-up doesn’t just add money—it supercharges growth.

The step up SIP calculator formula nails this, illustrating how small changes build into big wealth.

FAQs on Step Up Sip Calculator Formula

Final Thoughts

The step up SIP calculator formula isn’t just numbers—it’s a smart way to plan finances. It mirrors real life: rising incomes, higher costs, shifting goals. Using it helps craft solid strategies.

Whether you’re new to SIPs or a pro with big dreams, grasping this formula brings clarity for planning. Online calculators make it easy to forecast, stay on track, and reach freedom.

With inflation and costs always climbing, flat SIPs won’t cut it. Step-up SIPs, powered by this formula, keep your money growing with your ambitions.

One Comment