Step Up SIP Calculator with Inflation

Investment Summary

Note: Calculations are for illustrative purposes only. Actual returns may vary based on market conditions.

These days, financial planning goes beyond just stashing away cash—it's about outpacing rising costs while watching your money grow steadily. Systematic Investment Plans (SIPs) are a fantastic way to build wealth over time. But throw inflation into the equation, and even a solid SIP might not cut it. That's why a step up SIP calculator with inflation is such a game-changer for today's investors. It mixes the magic of compounding with yearly boosts and inflation tweaks, painting a true-to-life picture of what your future wealth could look like.

Understanding the Basics of a SStep Up SIP Calculator with Inflation

A standard SIP lets you put in a set amount regularly, usually monthly, and watch it grow through compounding. But life changes—your income goes up, bills increase, and inflation nibbles away at your money's value. Enter the step up SIP: it allows you to bump up your contributions gradually, say every year, to match those salary raises.

When you factor in inflation, a SIP calculator with step up and inflation becomes a must-have. It doesn't just track your increasing investments; it also accounts for how money loses value over time.

Why Inflation Matters in SIP Investments

Inflation quietly chips away at what your money can buy. For example, something that costs ₹1,000 now might set you back ₹1,600 in a decade if inflation hovers around 5%. If your investments aren't keeping up, your savings might seem impressive on paper but fall flat in reality.

A step up SIP calculator with inflation helps you tackle this head-on. It adjusts your plans so that when you're mapping out big goals—like retiring comfortably, funding kids' education, or snagging a home—you're looking at the genuine value, not just big numbers.

How a Step Up SIP Calculator with Inflation Works

This tool pulls together three main pieces:

- Initial SIP Amount: Your starting monthly contribution.

- Step Up Percentage: The yearly increase, like 10% or 15%.

- Inflation Rate: The average inflation you expect over the years.

By weaving these in, the SIP calculator with step up and inflation forecasts your final amount in real-world terms. It shows not only the total you'll have but also what that money will actually be worth down the line.

The Formula Behind Step Up SIP with Inflation

The online calculator does the math for you, but knowing the basics can make things clearer:

Future Value = Σ [ (SIP × (1 + Step-up %) ^ year) × (1 + r/n) ^ (nt) ] ÷ (1 + inflation rate) ^ year

Where:

- SIP = Your base monthly investment

- Step-up % = The annual bump in your SIP

- r = Expected annual return

- n = How often it compounds

- t = Total investment years

- Inflation rate = Projected yearly inflation

This tweak gives you the true buying power of your savings, beyond just the surface-level returns.

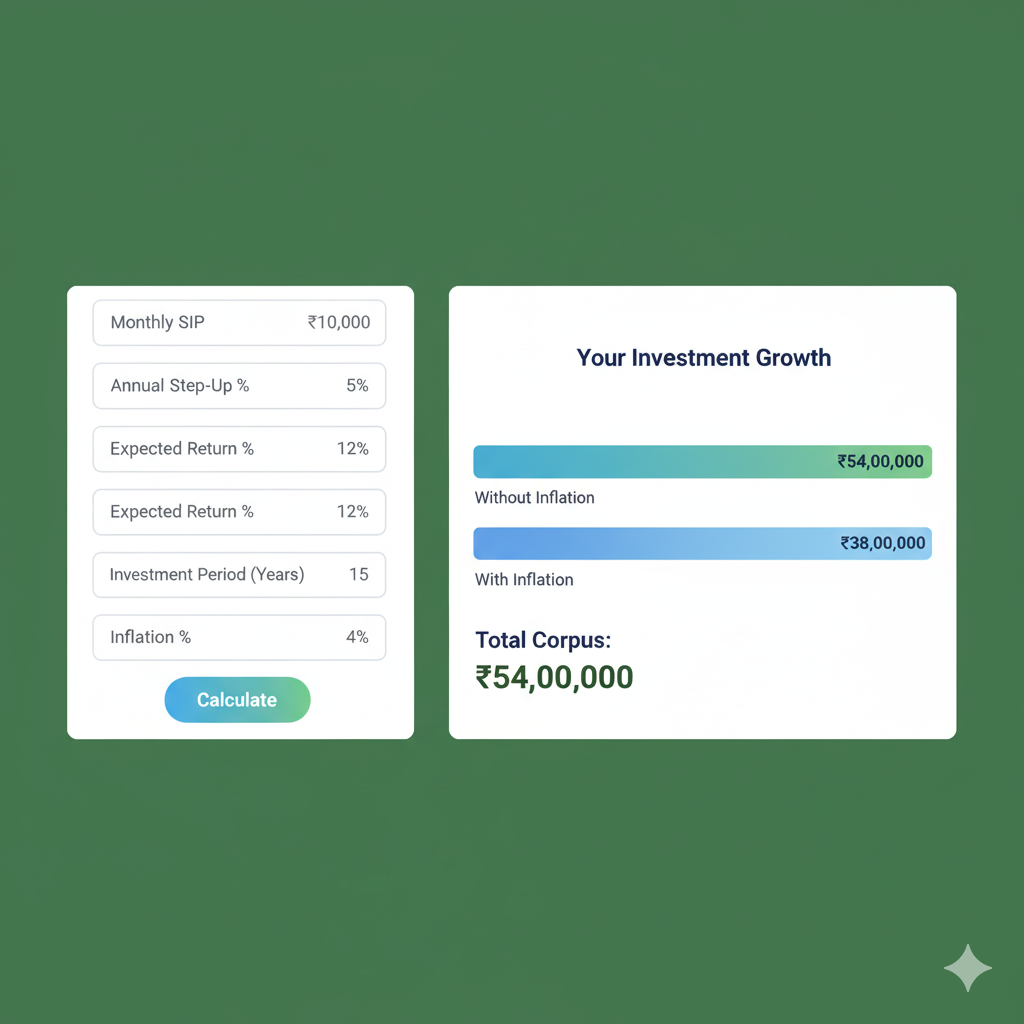

Example: Step Up SIP Calculator with Inflation

Let's walk through a quick scenario:

- Monthly SIP = ₹10,000

- Step-up = 10% annually

- Expected return = 12% per year

- Tenure = 20 years

- Average inflation = 6%

Without considering inflation, a step up SIP calculator might project over ₹1.5 crore. But factoring it in, the real value could drop to about ₹80–90 lakhs in today's terms.

This shows why a SIP calculator with step up and inflation offers a more grounded path for your finances.

Advantages of Using a Step Up SIP Calculator with Inflation with Step Up and Inflation

Realistic Financial Projections

Unlike basic SIP tools, this one delivers future values tweaked for inflation, so you don't overestimate what you'll end up with.

Helps Beat Inflation

Ramping up your contributions year by year gives your investments a fighting chance to grow quicker than rising prices.

Aligns with Income Growth

As your salary or business earnings climb, the step-up keeps your investments in step with your improved finances.

Smarter Goal Planning

Planning for retirement or major buys? The step up SIP calculator with inflation gives estimates in current value, making your targets more doable.

Step Up SIP Calculator with Inflation vs Regular SIP

A classic SIP is straightforward but doesn't budge—it ignores your evolving finances or the creeping cost of living. On the flip side, a SIP calculator with step up and inflation lets you invest more as you earn more, while crunching the numbers for real value post-inflation.

This shifts your focus from chasing big digits to building actual usable wealth.

Why Online Calculators are Better than Manual Calculations

Sure, you could crunch the numbers by hand, but juggling step-ups and inflation gets messy fast. Online versions of the step up SIP calculator with inflation make it effortless and error-free. Plug in your details, and boom—results in seconds.

Who Should Use a Step Up SIP Calculator with Inflation?

This is a great fit for:

- Salaried folks getting those yearly raises.

- Entrepreneurs seeing their profits expand.

- Parents socking away for school or weddings.

- Anyone eyeing retirement without skimping on lifestyle amid higher costs.

Basically, if you're in it for the long haul with wealth building, a SIP calculator with step up and inflation helps dodge nasty surprises.

The Psychological Advantage of Step Up SIP Calculator with Inflation

There's a mental perk that's easy to miss. Kicking off with smaller amounts and easing into bigger ones as you go lightens the load at the start. As your income rises, upping contributions feels natural. The calculator keeps you motivated by displaying those inflation-adjusted outcomes.

Building Wealth in the Real World

Investing isn't purely about the figures—it's making sure your dreams are within reach. Inflation often gets overlooked, but it's the sneakiest wealth killer. A step up SIP calculator with inflation shines a light on it. Folding it into your strategy means you're approaching financial freedom with eyes wide open.

FAQs on Step Up SIP Calculator with Inflation

Final Thoughts

In a world where inflation is always lurking, skipping it in your plans is like navigating without direction. The step up SIP calculator with inflation, along with the SIP calculator with step up and inflation, gives investors the insight they need. You move past rosy projections to grasp the true worth of your future savings.

Merging step-up investments with inflation smarts keeps your goals solid, even as the economy twists and turns. If you're all in on building wealth and securing your independence, this tool isn't optional—it's a necessity.