Step Up SIP Return Calculator

Calculate your wealth with increasing SIP investments

Investment Summary

Annual Step-Up

₹0

Last Year SIP

₹0

ROI

0%

Note: This calculator provides an estimate of potential returns. Actual returns may vary based on market conditions.

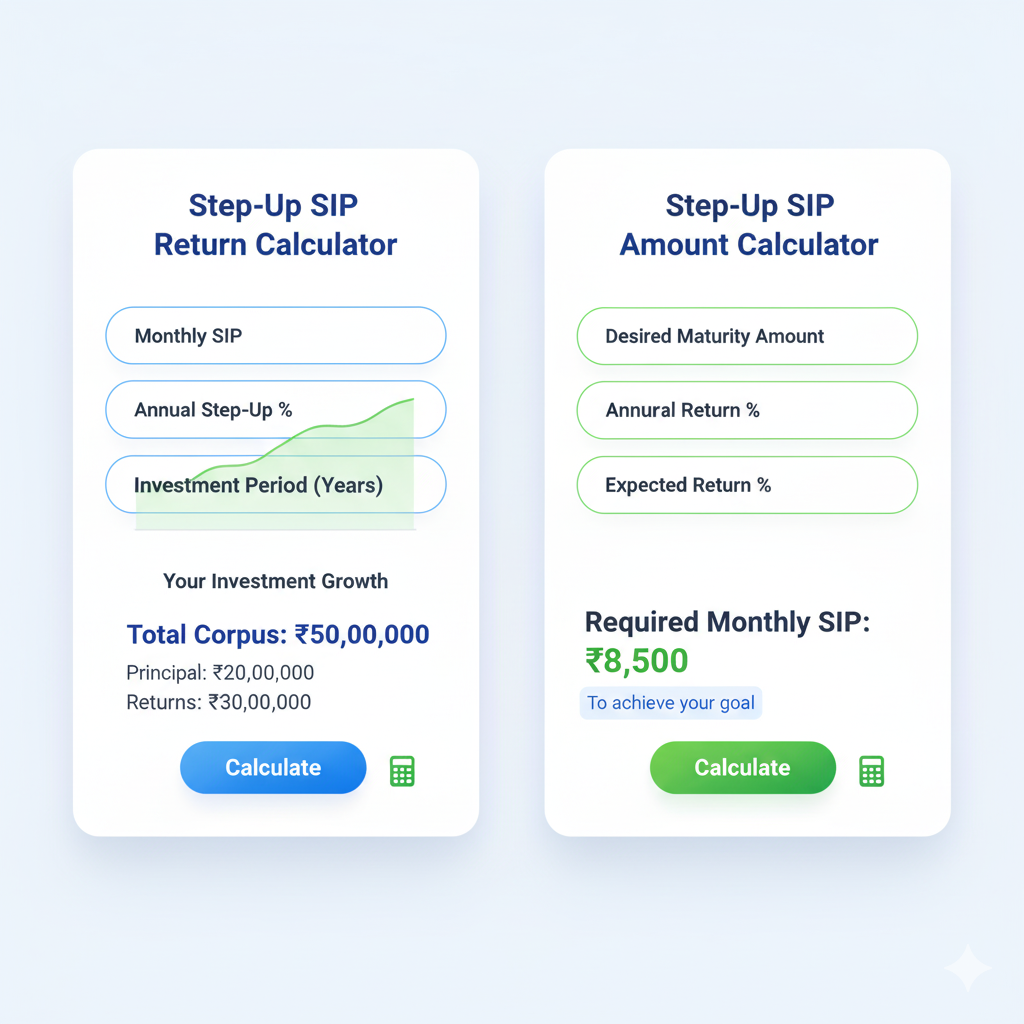

Investing wisely has become a necessity in today’s fast-changing financial environment. Among the most trusted tools for wealth creation, Systematic Investment Plans (SIPs) stand out. They allow individuals to invest a fixed sum every month into mutual funds, harnessing the power of compounding. However, as incomes grow and inflation rises, a fixed SIP may not be enough. That’s where step-up SIPs come in. To truly understand how much wealth you can create, the step up SIP return calculator and the step up SIP calculator with amount are game changers.

What is a Step Up SIP Return Calculator?

A step up SIP return calculator is an online financial tool designed to calculate the maturity value of investments when the SIP amount is increased regularly. Unlike a regular SIP calculator, which assumes a static investment amount throughout the tenure, this calculator allows investors to model incremental increases in their monthly contributions.

For example, if you start with ₹5,000 per month and increase it by ₹500 every year, the calculator will factor in those rising contributions and show how much wealth you will accumulate over time. It bridges the gap between theoretical returns and practical financial planning.

Why Investors Need a Step Up SIP Return Calculator with Amount

Many people only focus on percentage increments when they think of step-up SIPs. But in real life, not everyone wants to calculate in percentages. Some investors prefer to raise their SIP by a fixed amount each year instead of a percentage. This is where the step up SIP calculator with amount proves useful.

Let’s say you earn a yearly salary increment and want to add ₹1,000 more to your SIP every year. This calculator helps you project the outcome by directly entering the exact amount you’ll add annually. It provides a more straightforward and practical way of visualizing growth for those who prefer simplicity over percentages.

The Growing Importance of Step Up SIP Return Calculator

India’s inflation rates and rising living costs have shown that traditional fixed SIPs may not be enough to keep up with future needs. A step-up SIP aligns your investments with your income growth. Over time, as salaries and business earnings rise, the increased contributions can make a massive difference to your final corpus.

The step up SIP return calculator highlights this impact clearly. By comparing static SIPs with stepped-up contributions, it reveals how incremental increases can nearly double your maturity amount over long tenures.

How Does a Step Up SIP Return Calculator Work?

While the online interface is simple, the logic behind it is powerful. You typically enter:

- Initial SIP amount

- Increment percentage or increment amount

- Expected rate of return

- Tenure in years

The calculator then projects future wealth. A step up SIP calculator with amount differs slightly by allowing you to specify the exact increment in rupees each year instead of percentages.

This makes it especially convenient for investors who prefer to plan with concrete numbers rather than abstract percentages.

Step Up SIP Return Calculator Formula Explained

Although most investors rely on calculators, the formula can be expressed as:

Future Value = Σ [ (SIP + (Step-up amount × Year)) × (1 + r/n) ^ (n × t) ]

Where:

- SIP = Initial monthly investment

- Step-up amount = Additional rupee amount added annually

- r = Expected annual return rate

- n = Number of compounding periods in a year

- t = Investment tenure in years

This formula shows how each year’s increased contribution compounds separately, leading to a much larger maturity amount.

Example of Step-Up SIP with Fixed Amounts

Consider this scenario:

- Initial SIP = ₹5,000 per month

- Step-up = ₹1,000 increase every year

- Expected return = 12% annually

- Tenure = 15 years

At the end of 15 years, a fixed SIP of ₹5,000 might grow to about ₹25 lakhs. But with a step up SIP calculator with amount, the maturity can jump to nearly ₹40–45 lakhs. That’s the power of gradual increments.

This demonstrates why both the step up SIP return calculator and the step up SIP calculator with amount are vital tools for forward-thinking investors.

Benefits of Using a Step Up SIP Return Calculator

Realistic Financial Planning

Instead of assuming flat contributions, you get to see how your wealth grows with your actual investment pattern.

Easy to Use

These calculators are designed to be simple. Input your details, and you get quick projections without manual math.

Motivates Higher Investments

When you see the impact of small increments on long-term wealth, it encourages disciplined saving and investing.

Flexible Options

While the percentage-based calculator works for those who think in terms of increments like 10% annually, the step up SIP calculator with amount is ideal for those who prefer absolute rupee increases.

Step-Up SIP vs Traditional SIP

A regular SIP is like running on cruise control—you invest a fixed sum every month without changes. It’s effective, but it doesn’t reflect your increasing financial capacity.

A step-up SIP, on the other hand, grows with you. As your income increases, so does your SIP. Over decades, this small habit change results in significantly higher wealth.

The step up SIP return calculator and the step up SIP calculator with amount both demonstrate this difference vividly, making them indispensable for long-term investors.

Why a Calculator with Amount is Especially Useful

While percentage-based increases sound professional, not everyone finds them intuitive. A salaried professional may find it easier to say, “I’ll add ₹2,000 more every year” rather than calculating 10% of the current SIP.

The step up SIP calculator with amount caters to this mindset. It allows investors to visualize growth in rupee terms, keeping financial planning simple and relatable.

Step-Up SIP for Different Financial Goals

Whether you’re saving for retirement, children’s higher education, or buying a house, the flexibility of increasing contributions annually helps you stay ahead.

For long-term goals like retirement, using the step up SIP return calculator ensures you’re accounting for both rising contributions and compounding. For medium-term goals like a child’s education in 10–12 years, the step up SIP calculator with amount gives a realistic picture of how much corpus you’ll accumulate.

Psychological Advantages of Step-Up SIPs

Investors often hesitate to start with a large SIP. With a step-up approach, you can start small and gradually increase contributions. This reduces the initial burden while still ensuring a substantial future corpus.

When you run the numbers through the step up SIP return calculator, the projected wealth can be highly motivating. Seeing the results encourages consistent investing habits, which are key to wealth creation.

The Role of Compounding in Step-Up SIPs

Compounding is often called the eighth wonder of the world. When combined with systematic increments, its effect multiplies dramatically. Each additional contribution compounds independently, meaning every extra rupee added grows into something much larger over time.

The step up SIP calculator with amount clearly showcases how even modest yearly increases build a financial cushion that beats inflation and secures future goals.

Things to Keep in Mind While Using Step-Up SIP Calculators

- Realistic Returns – Don’t assume overly high returns. Keep projections moderate, like 10–12%.

- Inflation Impact – Remember that the maturity amount must be seen in the context of inflation-adjusted value.

- Discipline – The success of step-up SIPs lies in consistently applying increments year after year.

FAQs on Step Up SIP Return Calculator

What is a step up SIP return calculator?

It is a tool that calculates the maturity amount of a SIP when contributions are increased regularly, either by percentage or fixed amount.

How is it different from a normal SIP calculator?

A regular SIP calculator assumes constant contributions, while the step up SIP return calculator factors in annual increments.

Is the calculator accurate?

It provides a close estimate based on your inputs, but actual returns may vary depending on mutual fund performance.

FAQs on Step Up SIP Calculator with Amount

Final Thoughts

Financial planning is not just about investing—it’s about investing smartly. The step up SIP return calculator and the Step Up SIP Return Calculator with amount empower investors to see realistic projections of their wealth. By incorporating annual increments, these calculators reflect how wealth grows in practical scenarios.

For those who think in percentages, the return calculator works best. For those who prefer simplicity in numbers, the amount-based calculator is ideal. Either way, both tools highlight how small, disciplined increases can make a massive difference over time.

In an era of rising expenses and unpredictable economic shifts, relying on static SIPs may not be enough. Step-up SIPs bridge that gap, ensuring your money works as hard as you do. By using these calculators regularly, investors can make smarter decisions and stay on track to meet their long-term goals with confidence.